estate tax exemption 2022 proposal

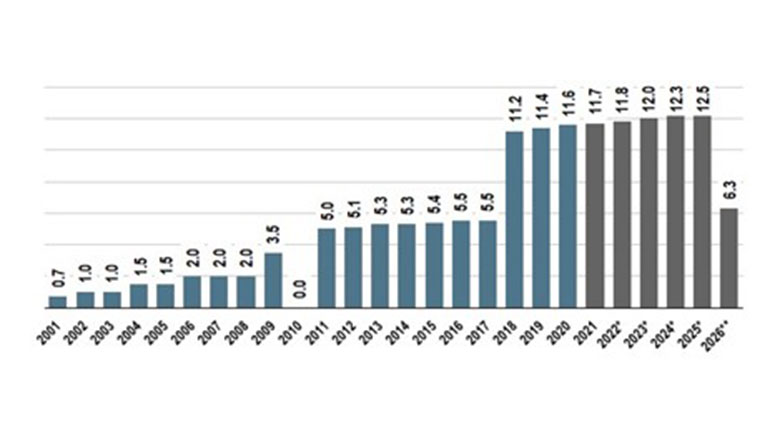

The exemption will increase with inflation to approximately 12060000 per person in 2022. 11700000 in 2021 and 12060000 in 2022.

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State.

. Proposed Estate Tax Exemption Changes. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends. Eliminating the so-called cliff effect of the Massachusetts estate tax.

The estate tax exemption is adjusted for inflation every year. Federal Estate Tax Exemption As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in. 2022 if the proposed law is enacted or before.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. Under current law the existing 10 million exemption would revert back to the 5 million exemption. If that person passes away in 2022 when the Lifetime Exemption is decreased to 6000000 then 4700000 of their 10000000 taxable estate.

Increase the top rate to 396 beginning in 2023. Currently the lifetime Estate and Gift Tax exemption is at 117 million but will revert back to approximately 62 million by 2026. Lower Estate Tax Exemption.

If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to. This election is made on a timely filed estate tax return for the decedent with. The generation-skipping transfer tax GST tax exemption amount will also decrease from 117 Million per person to 5 Million per person.

The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts for non-operating businesses and. Here is what you need to know. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

As of January 1 2022 that will be cut in half. If enacted the current 117 million per person estate and gift tax exemption would be reduced to 602 million for 2022 based on current estimates. The proposed 995 Act never materialized.

A provision of the proposed legislation that would become effective Jan. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption. Estates of decedents survived by a spouse may elect to pass any of the decedents unused exemption to the surviving spouse.

Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. Estate Tax Proposal 1 Reduction of the Lifetime Estate and Gift Tax Exemption. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would.

In late January 2022 the Baker-Polito Administration filed a comprehensive tax proposal which would make several changes to the Massachusetts estate tax including by increasing the Massachusetts exemption amount. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset on January 1 2026. The House estate tax proposal is to accelerate the 2026 reduction to 2022.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. Estate tax exemption 2022 proposal.

With inflation this may land somewhere around 6 million. Grantor trusts retain the same benefits and the Generation Skip Tax is equivalent to the estate tax exemption levels. The Tax Cuts and Jobs Act which was enacted in December 2017 provided that the current 10000000 base exemption amount for the estate gift and Generation-Skipping Transfer taxes is effective through 2025 and reverts on January 1 2026 to the 5000000 base exemption amount established by the American Taxpayer Relief Act of 2012.

The good news is that the once-in-a-lifetime estate and gift tax exemption of 10 million as adjusted for inflation presently 117 million per taxpayer or 234 million for married couples. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for inflation. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

The size of the estate tax exemption meant that a mere 01 of. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies. The effective date of these tax rates and the tax bracket is January 1 2022.

The top rate would apply to taxable income over. Sunday May 29 2022. Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions.

For people who pass away in 2022 the Federal exemption amount will be 1206000000. Get information on how the estate tax may apply to your taxable estate at your death. And modifying the method for taking into.

The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend. With no major changes now is the time to strike in Estate Planning. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

2022 Estate Gift Tax Exemption Exclusion. The federal estate tax exemption for 2022 is 1206 million. Some taxpayers made transfers usually to.

The Time To Gift Is Now Potential Tax Law Changes For 2021. In 2026 the exemption is predicted drop to about 6600000 per person. This is an increase from 1170000000 for 2021.

However the change to the top capital gains rate which is increased to 25 is effective beginning after September. Increase the top rate to 396 beginning in 2023. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends.

Biden Greenbook Estate Tax Proposals Should You Care

Proposed Tax Law Changes Which May Impact You Certilman Balin

It May Be Time To Start Worrying About The Estate Tax The New York Times

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

What The 2021 Tax Proposals Mean The American Families Plan Cpa Practice Advisor

What Happened To The Expected Year End Estate Tax Changes

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Pin By Debbie Wolfe On Estates Vacation Home Vacation Estates

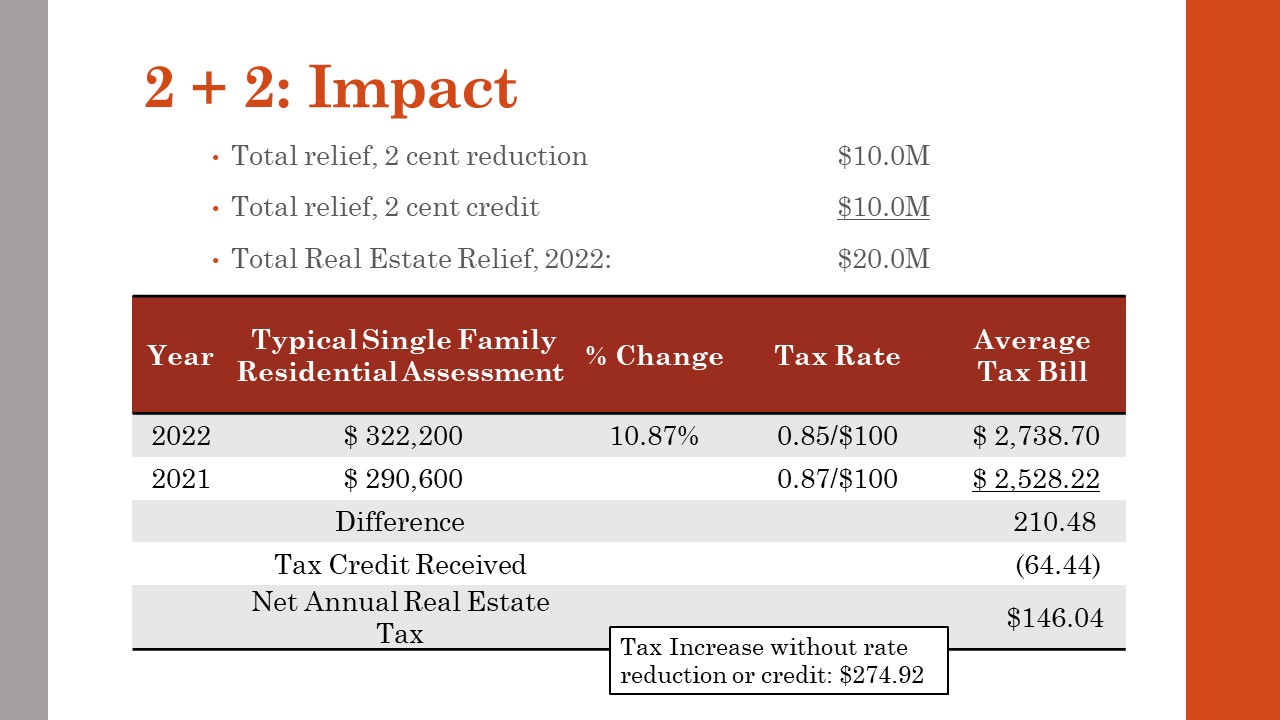

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Pin By Debbie Wolfe On Estates Vacation Home Vacation Estates